I never used to believe in miracles. The world felt too harsh, too random. But that was before I heard Niyonzima Diyodon’s story. His life is not just a story of survival; it’s a series of events so improbable, so perfectly timed, that they defy any other explanation. Niyonzima Diyodon was born in a warzone and has lived his entire life as a refugee. Now, he’s building a financial institution from within a Ugandan settlement to serve those who, like him, have been left behind by the formal banking system.

It’s up to us to develop solutions that truly address our own challenges

Niyonzima Diyodon

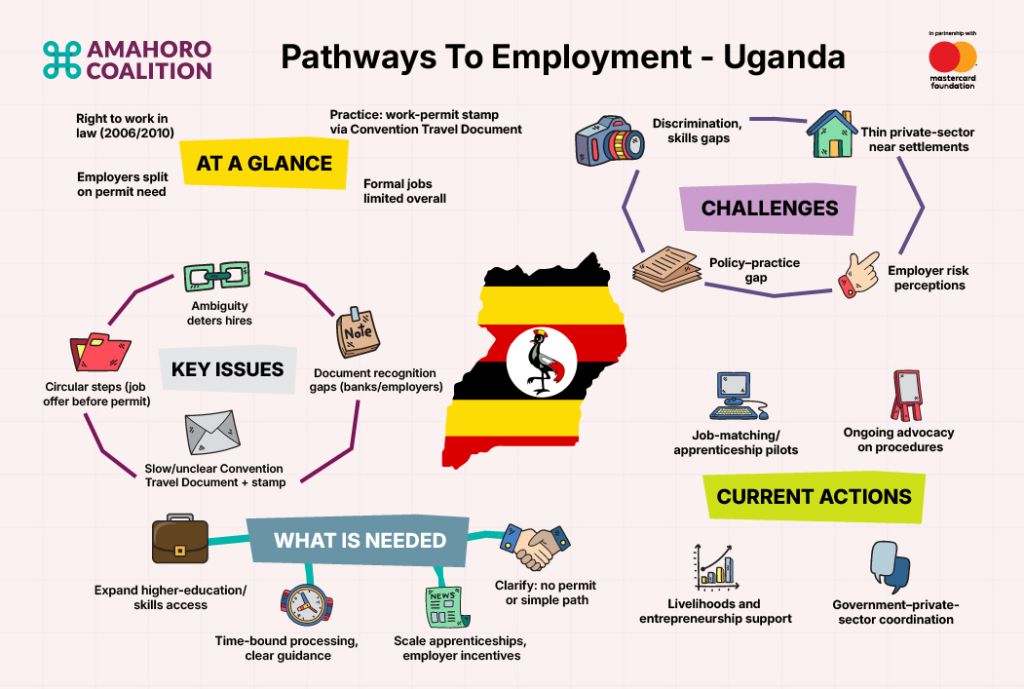

A system that excludes

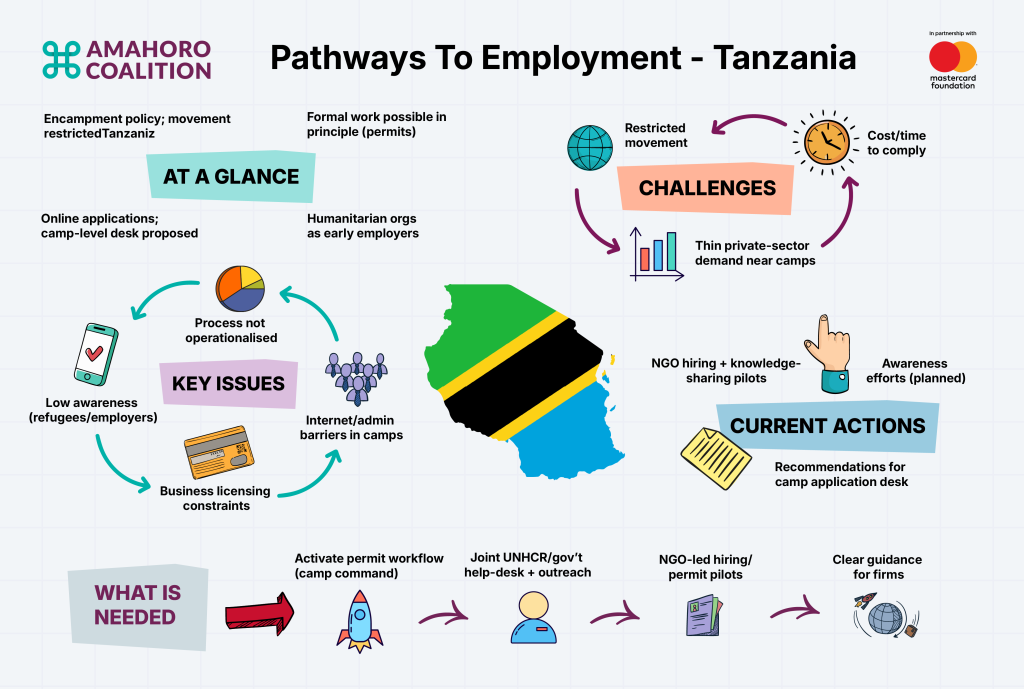

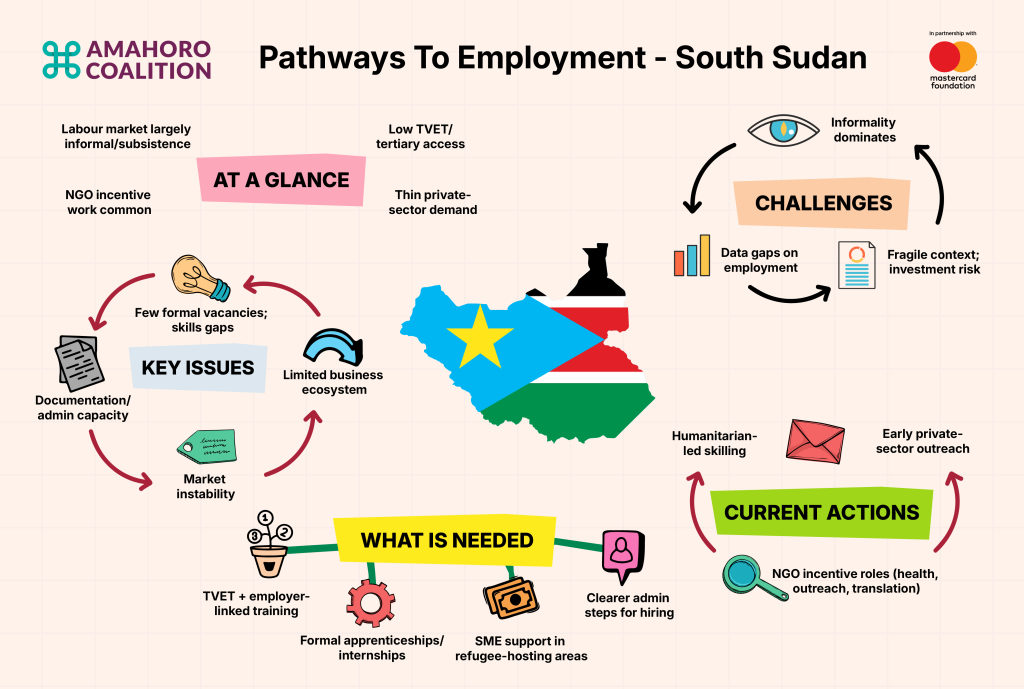

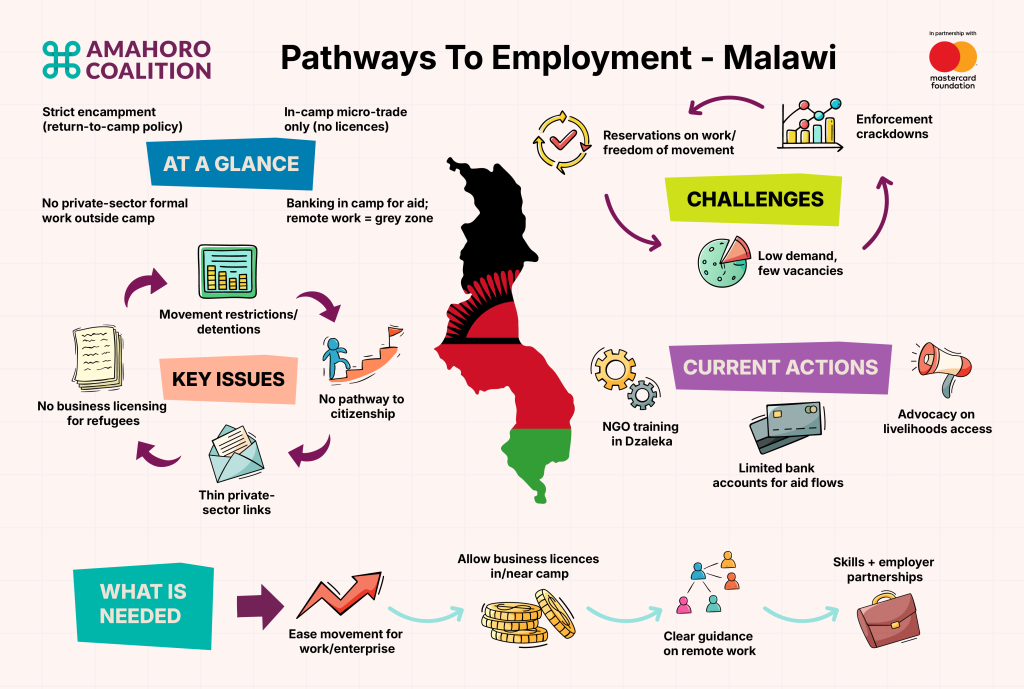

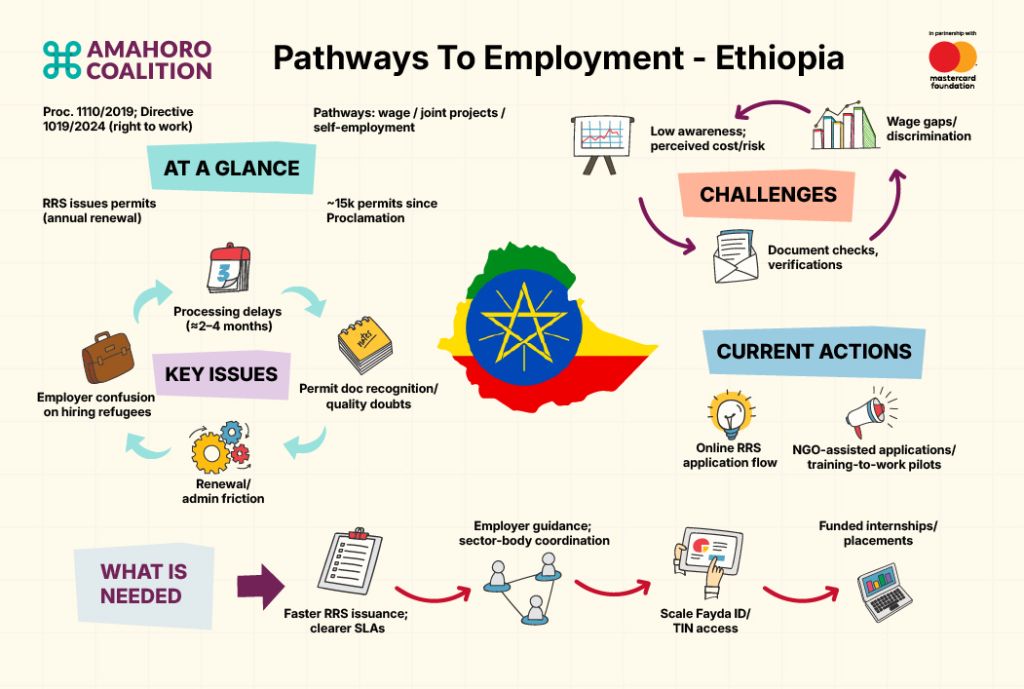

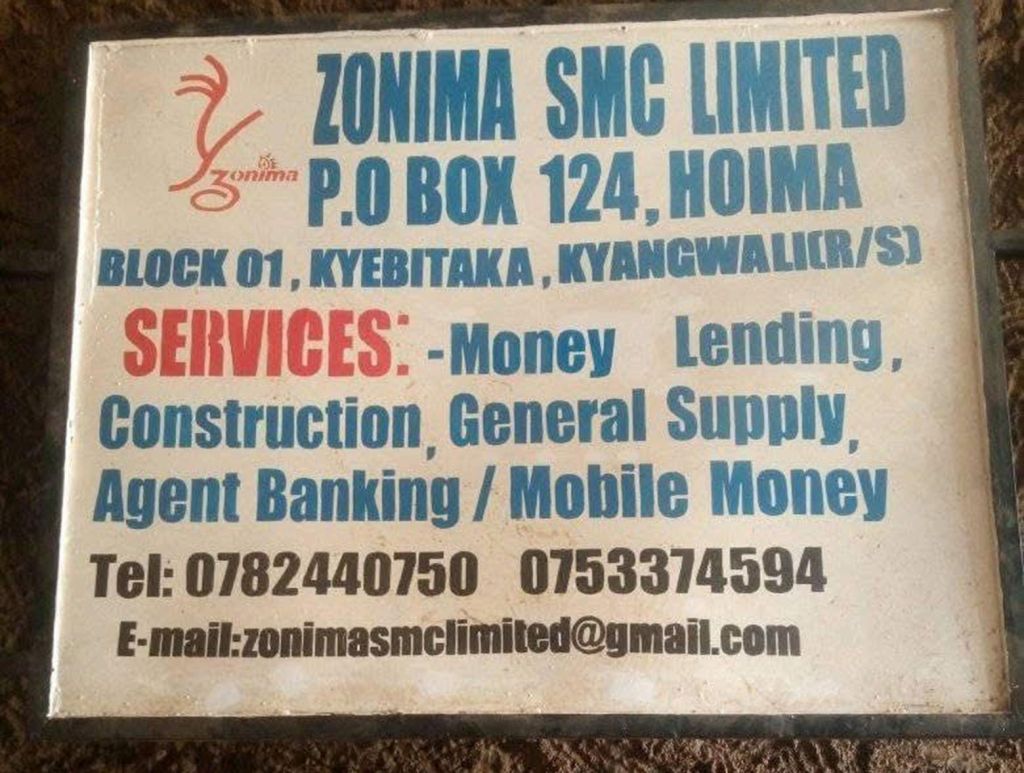

In the Kyangwali refugee settlement in Uganda, Niyonzima Diyodon is tackling a problem that plagues refugees across the continent: a lack of access to financial services. His organization, Zonima SMC, provides microfinance and financial literacy to fellow refugees. According to the Amahoro Coalition’s recent Pathways to Employment report, only 17% of refugees in Uganda out of 1.6 million have a bank account, leaving the vast majority without the financial tools needed to build a secure future.

For Niyonzima, this mission is deeply personal, forged from a life of displacement that began before he could even form memories. He was born in a forest during the brutal war in the Democratic Republic of Congo between 1998 and 2000. His mother had already spent three weeks fleeing rebel attacks, moving aimlessly through the bush with no destination other than survival.

In the chaos of war, the birth of a child was a liability. The norm was to leave newborns behind, as a baby’s cry could lead to the death of an entire group. But Niyonzima’s birth was marked by what his family saw as miracles. A razor blade to cut the umbilical cord appeared in a bag just when it was needed; rain began to fall in a dry season, and a single, wet matchstick miraculously lit a fire. A Rwandan man, convinced the boy was special, insisted on carrying him.

This sense of a special destiny would follow him. After a perilous journey, the family reached a camp in Rwanda, where his father was nearly killed before being spared. Weeks later, Niyonzima fell ill, and the camp’s residents helped his family get to a transit center in Uganda for medical care. The fever vanished upon arrival. They later learned the camp they had just left was attacked, and many were killed. The event gave him his name, Niyonzima, which means “God is still alive.”

“That belief they believed in me,” he says, “is what motivates me every day.”

From Survival to a Sustainable Solution

Growing up in the Kyangwali settlement, he faced immense hardship, often going days without food. School became a lifeline, a place to find a meal and a connection to a world outside of poverty. After finishing his studies, he saw how his community struggled. When a new influx of refugees arrived, established residents had to forfeit their farmland, forcing many to start businesses out of desperation, without the necessary skills.

His first attempt to help was a pig-rearing project, which ultimately failed due to a disease outbreak. He then tried a savings group, but with predatory interest rates of 20% per month, the model felt more harmful than helpful. Finally, in 2019, he struck out on his own, using his savings to provide small loans to individuals at a fair rate. He paired the capital with crucial financial literacy training and one-on-one mentorship, ensuring businesses had the support they needed to grow. This became the model for Zonima SMC, which he officially registered in 2021.

Today, Zonima stands as a vital community pillar. It has strategically reduced its interest rate to 5% per month, the lowest in the area and operates on a cash-based model to save clients from bank fees. With a dedicated team of six, the organization has provided crucial financial literacy training to 300 participants. It currently manages an active loan portfolio of 50 borrowers—75% of whom are women—with loans ranging from UGX 50,000 to UGX 3,000,000 and a capital base of UGX 30,000,000.

His work eventually caught the attention of the Amahoro Coalition, an organization that supports young leaders in underserved communities. Despite his initial skepticism, he applied and was accepted into their fellowship, an opportunity he describes as “life-changing.” Today, with the help of Amahoro Coalition, Zonima SMC has trained hundreds and provided loans to over 150 people, with plans to reach 50 more youth and women. But Niyonzima’s vision extends far beyond the settlement. Within five years, he wants Zonima SMC to be a fully-fledged bank—one with its headquarters in a refugee camp.

“A bank that understands the pain of refugees,” he says, with a quiet determination. It’s an audacious dream, born from a life of impossible odds, and one that could rewrite the future for the displaced across Africa.